GIBELLINI (VANADIUM)

Related Documents

Gibellini Presentation 2020 (pdf)

Gibellini Presentation 2020 (pdf)

November 2017 Gibellini Technical Report (pdf)

November 2017 Gibellini Technical Report (pdf)

June 2018 Gibellini Preliminary Economic Assessment (pdf)

June 2018 Gibellini Preliminary Economic Assessment (pdf)

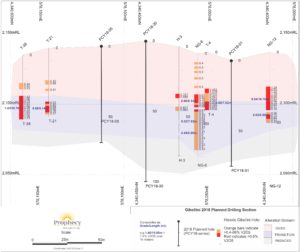

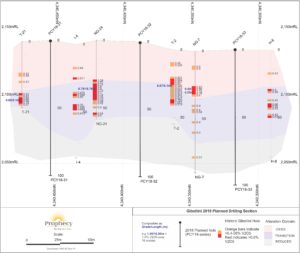

Gibellini Vanadium Project Timeline

GIBELLINI PROJECT SUMMARY

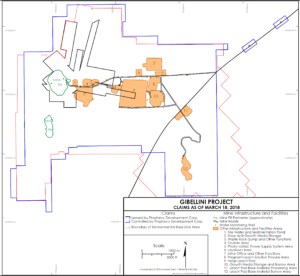

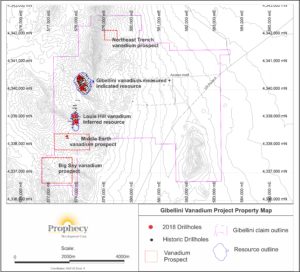

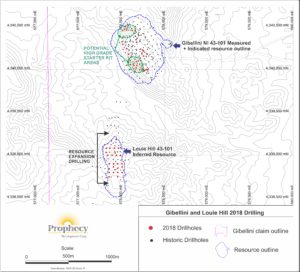

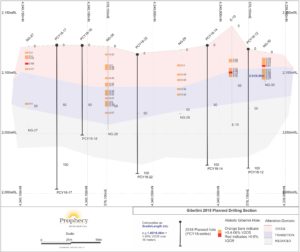

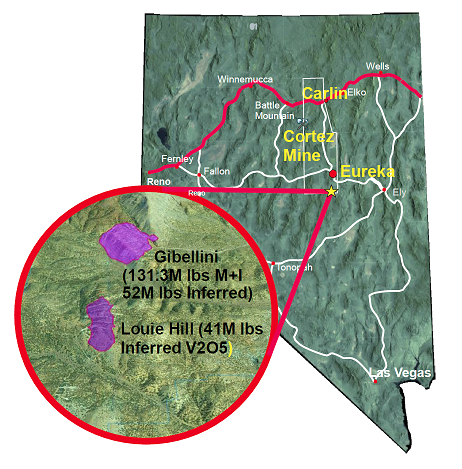

Gibellini Vanadium Project, designed to be an open pit, heap leach operation in Nevada, USA – ranked #1 Mining Jurisdiction in the World, by Fraser Institute. The project is located about 25 miles south of the town of Eureka. Nevada Vanadium holds a 100% interest in the properties by way of a lease agreement and staked claims. The project consists of Gibellini and Louie Hill vanadium deposits, located in close proximity of each other.

Gibellini Vanadium Project, designed to be an open pit, heap leach operation in Nevada, USA – ranked #1 Mining Jurisdiction in the World, by Fraser Institute. The project is located about 25 miles south of the town of Eureka. Nevada Vanadium holds a 100% interest in the properties by way of a lease agreement and staked claims. The project consists of Gibellini and Louie Hill vanadium deposits, located in close proximity of each other.

Nevada Vanadium, LLC. (“Nevada Vanadium” or the “Company”) is pleased to announce that its Gibellini Project passed an important milestone yesterday as its Notice of Intent (“NOI”) to prepare an Environmental Impact Statement (“EIS”) was published in the Federal Register. If approved, Gibellini would become the first U.S. primary vanadium mine.

The Gibellini Project, located in Eureka County, Nevada, USA, is 100% owned by Nevada Vanadium. Nevada Vanadium is a Nevada corporation and a wholly owned subsidiary of Silver Elephant Mining Corp.

The Gibellini Project has been designed as a potential model of sustainability in the extraction and processing of critical minerals required for a low-carbon economy and greater renewable energy deployment. Vanadium is an important component in lightweight steel and has the potential to increase the life and reduce the cost of batteries when used in utility-scale wind and solar projects.

“The publication of the Notice of Intent is a major milestone for the Gibellini Project, which will produce nearly 10 million pounds of vanadium annually if approved,” said Ron Espell, Nevada Vanadium’s Vice President for Environment and Sustainability.

“That represents greater than 50 percent of U.S. demand which is now entirely met by imports from foreign nations. Nevada Vanadium wants to ensure U.S. production of this strategic and critical mineral is domestic and secure.”

The U.S. government has designated vanadium a critical mineral of strategic importance to the nation. Its many applications as an alloy and catalyst span the aerospace, defense, energy, and infrastructure sectors.

“We look forward to working with all stakeholders to bring to life a project that will benefit them while becoming a model for environmental protection and safe operations,” Espell said. “We would like to thank the U.S. Bureau of Land Management’s Battle Mountain District Office and all of the contractors that have helped us bring the project to this point, and we are looking forward to a final approval that will help diversify Eureka County’s economy, create skilled labor demand and contribute to the security of our nation.”

The project is expected to create 120 jobs during the proposed 18-month construction and commissioning period, and approximately 100 full-time jobs are anticipated during regular operations. The Gibellini Project will add vanadium to Eureka County’s mining output, that has generally been limited to gold and silver, which are subject to cyclical precious metal price swings.

In his statement regarding Gibellini, U.S. Bureau of Land Management (BLM) Battle Mountain District Manager Doug Furtado said that, “If approved, this project would provide hundreds of jobs and will contribute to the nation’s domestic source of critical minerals.” Furtado went on to say that “The Gibellini mine would also be the first vanadium mine in the U.S. and, in accordance with Secretarial Order 3355, we anticipate having a record of decision in 12 months.”

The publication of the NOI follows the final Mine Plan of Operations (MPO), Project Enhanced Baseline Reports (EBRs) and Pre-Planning Supplemental Environmental Reports that were accepted by BLM prior to the start of the NEPA analysis.

The MPO includes the construction, operation and closure of the Project, which is an open pit mining operation and heap leach process facility to extract and recover 132 million pounds of vanadium over its lifetime. The engineering design took into account baseline reporting that started in 2010 and includes state-of-the-art environmental control systems that help avoid or minimize potential environmental impacts while exceeding regulatory requirements.

Nevada Vanadium’s engagement with local, state, and federal government regulatory agencies and local stakeholders is planned to continue over the next year in anticipation of the ROD being issued by the second quarter of 2021.

Per Press Release dated June 2, 2020 from US Department of Commerce which Initiated Section 232 Investigation into Imports of Vanadium

“Vanadium is utilized in our national defense and critical infrastructure, and is integral to certain aerospace applications,” said Secretary Ross. “We will conduct a thorough, fair, and transparent investigation to determine whether vanadium imports threaten to impair U.S. national security.”

Vanadium is a metal used in production of metal alloys and as a catalyst for chemicals across aerospace, defense, energy, and infrastructure sectors. Designated a strategic and critical material, vanadium is used for national defense and critical infrastructure applications. Examples include aircraft, jet engines, ballistic missiles, energy storage, bridges, buildings, and pipelines. Vanadium is a key component in aerospace applications due to its strength-to-weight ratio, the best of any engineered material. U.S. demand is supplied entirely through imports.

The preliminary economic assessment “PEA” was completed on May 29, 2018 and reported an after tax cumulative cash flow of US$601.5 million, an internal rate of return of 50.8%, a net present value of US$338.3 million at a 7% discount rate and a 1.72 years payback on investment from start-up assuming an average vanadium pentoxide price (V2O5) of $12.73 per pound. As of April 3, 2019, the price of vanadium pentoxide is $15 per pound according to www.asianmetal.com. The PEA was prepared by Amec Foster Wheeler E&C Services Inc. (“AMEC”), part of the Wood Group of companies.

The PEA Highlights

| Internal rate of return | 50.8% |

| Net present value (NPV) | $338.3 million at 7% discount rate |

| Payback period | 1.72 years |

| Average annual production | 9.65 million lbs V2O5 |

| Average V2O5 selling price | $12.73 per lb |

| Operating cash cost | $4.77 per lb V2O5 |

| All-in sustaining costs* | $6.28 per lb V2O5 |

| Breakeven price** | $7.76 per lb V2O5 |

| Initial capital cost including 25% contingency | $116.76 million |

| Average grade | 0.26% V2O5 |

| Strip ratio | 0.17 waste to leach material |

| Mining operating rate | 3.4 million tons (leach material and waste) per year |

| Average V2O5 recovery through Direct Heap Leaching | 62% |

| Life of mine | 13.5 years |

*Includes selling costs, royalties, operating cash cost, reclamation, exploration and sustaining capital costs.

**Includes selling costs, royalties, operating cash costs, taxes (local, state, and federal), working capital, and sustaining & capital costs.

Vanadium was the best performing metal in 2016. The main driver for this has been new rebar standards set in place in China phasing out Grade 2 rebar and pushing for Grade 3 rebar (which requires 36 grams of vanadium to be added to 1,000 tons) across real estate and industrial applications. China mandated a minimum amount of vanadium to be added in all future rebar construction, as vanadium increases the tensile strength of steel. As a result, global demand for vanadium is expected to increase by 20% in the short term.

Vanadium Pentoxide Price 98% min

The following factors could attribute to higher vanadium prices in 2020 and beyond

+ Enforcing New Chinese Rebar Standards

+ Further Raising Environmental Standards

+ Rising demand from Vanadium Batteries

Offtake and Project Financing

Nevada Vanadium has received unsolicited expressions of interest from various potential investment sources, and is currently engaged in discussions with potential cornerstone investors, vanadium product off-takers and banks on potential equity, debt and prepaid off-take financing possibilities. We expect to report material progress in due course.

Gibellini Project Water and Power Supply

On August 20, 2018, the Company secured water supply for the Gibellini Project construction and operation. The Company signed a 10-year Agreement with the owner of a private ranch, located approximately 14.5 km from the Gibellini Project. The Agreement can be extended for any number of additional 7-year terms, not to exceed (with the primary term) a total of 99 years.

As per the terms of the Agreement, the lessor granted to Nevada Vanadium rights to 805 acre-feet (approximately 262.4 million gallons) of water per year for the Gibellini Project, at a minimum flow rate of 500 gallons per minute (“gpm”) from its year-round springs surface water stream. The water flow rate was measured at the ranch springs in 1965, in 1981, from December 2011 to September 2013, and most recently, in 2017. The water flow rate ranges from 1,000 to 3,900 gpm with an average flow rate of 2,690 gpm, which exceeds the project’s maximum water operational requirement of 420 gpm based on the process engineering design prepared by Scotia International of Nevada, Inc. as a part of engineering, procurement, construction and management work done in 2014.

The Gibellini Project completed water-related baseline studies including the drilling of water-test wells, water source data collection, characterization, flow rate testing and modeling. Due to the fact that the Agreement provides a source of water from surface springs located on a private ranch and baseline studies related to it have been completed, Nevada Vanadium expects to significantly expedite the permitting process by eliminating the need to appropriate water rights from the Nevada Division of Water Resources “DWR”.

The power supply for the Gibellini Project site is assumed to be at 24.9 kV and supplied from a planned substation to be located near Fish Creek Ranch. This substation would tap and step-down the 69kV supply carried by the line to the Pan Mine to 24.9kV and place it on a line to the Gibellini Project. Negotiations with the power utility, Mt. Wheeler Power, would need to be undertaken to secure any future power supply contract and transmission line to the site.

PEA

On May 29, 2018, the Company received results of a PEA for the Gibellini Project. The PEA reported an after tax cumulative cash flow of $601.5 million, an internal rate of return of 50.8%, a net present value of $338.3 million at a 7% discount rate and a 1.72 years payback on investment from start-up assuming an average vanadium pentoxide price of $12.73 per pound. As of April 3, 2019, the price of vanadium pentoxide is $14.9 per pound according to www.asianmetal.com. The PEA was prepared by Wood and is based on the NI 43-101 compliant resource calculations reported above.

Sensitivity Analysis

The tables below show the sensitivity analysis to the vanadium pentoxide price, grade, and to the PEA capital cost and operating costs. This sensitivity analysis indicates strong project economics even in very challenging conditions, and that the project is well positioned to benefit from the current rising vanadium price environment. A 20% increase in the vanadium price relative to the base case translates to a USD$491.3 million after-tax NPV at a 7% discount rate.

| V2O5 price change |

V2O5 price $/lb |

After-tax IRR |

After-tax NPV $M @ 7% |

After-tax cashflow $M |

| 30% | 16.55 | 69% | 568.0 | 996.0 |

| 20% | 15.28 | 63% | 491.3 | 864.4 |

| 10% | 14.00 | 57% | 415.2 | 733.2 |

| Base price | 12.73 | 51% | 338.3 | 600.4 |

| -10% | 11.46 | 44% | 261.0 | 467.2 |

| -20% | 10.18 | 36% | 183.1 | 333.2 |

| -30% | 8.91 | 26% | 103.9 | 196.9 |

| V2O5 grade change |

V2O5 grade |

After-tax IRR |

After-tax NPV $M @ 7% |

After-tax cashflow $M |

| 30% | 0.34% | 68% | 554.4 | 972.8 |

| 20% | 0.31% | 63% | 482.4 | 849.0 |

| 10% | 0.28% | 57% | 410.7 | 725.4 |

| Base grade | 0.26% | 51% | 338.3 | 600.4 |

| -10% | 0.23% | 44% | 265.6 | 475.0 |

| -20% | 0.21% | 37% | 192.2 | 348.9 |

| -30% | 0.18% | 28% | 118.3 | 221.6 |

| Capex change |

Capex $M |

After-tax IRR |

After-tax NPV $M @ 7% |

After-tax cashflow $M |

| 30% | 151.8 | 40% | 307.2 | 564.3 |

| 20% | 140.1 | 43% | 317.6 | 576.3 |

| 10% | 128.4 | 47% | 328.0 | 588.4 |

| Base Capex | 116.8 | 51% | 338.3 | 600.4 |

| -10% | 105.1 | 55% | 348.6 | 612.5 |

| -20% | 93.4 | 61% | 358.9 | 624.6 |

| -30% | 81.7 | 67% | 369.3 | 636.8 |

| Opex change |

Opex $M |

After-tax IRR |

After-tax NPV $M @ 7% |

After-tax cashflow $M |

| 30% | 6.20 | 45% | 257.9 | 450.2 |

| 20% | 5.72 | 47% | 284.8 | 500.3 |

| 10% | 5.25 | 49% | 311.6 | 550.4 |

| Base Capex | 4.77 | 51% | 338.3 | 600.4 |

| -10% | 4.29 | 53% | 364.8 | 650.0 |

| -20% | 3.82 | 55% | 390.7 | 698.4 |

| -30% | 3.34 | 56% | 416.0 | 745.4 |

Mining and Processing

Mining at the Gibellini and Louie Hill projects is planned to be a conventional open pit mine utilizing a truck and shovel fleet comprised of 100-ton trucks and front end loaders. Average mine production during the 13.5 year mine life is 3.4 million tons of leach material (3 million tons) and waste (0.4 million tonnes) per year at a strip ratio of 0.17. Mining is to be completed through contract, with Nevada Vanadium’s mining staff overseeing the contracted mining operation and performing the mine engineering and survey work.

| Oxide ‘000 tons |

Transition ‘000 tons |

Reduced ‘000 tons |

Grade % V2O5 |

Metal contained V2O5 (Mlb) |

Metal Produced V2O5 (Mlb) |

|

| YR 1 | 2,600 | 400 | — | 0.291 | 17.440 | 10.633 |

| YR 2 | 2,400 | 600 | — | 0.278 | 16.690 | 10.480 |

| YR 3 | 1,760 | 1,240 | — | 0.310 | 18.580 | 12.067 |

| YR 4 | 650 | 2,350 | — | 0.372 | 22.320 | 15.217 |

| YR 5 | 310 | 2,680 | 10 | 0.366 | 21.950 | 15.185 |

| YR 6 | 2,240 | 750 | 10 | 0.315 | 18.920 | 11.928 |

| YR 7 | 3,000 | — | — | 0.316 | 18.980 | 11.394 |

| YR 8 | 1,910 | 700 | 380 | 0.189 | 11.310 | 7.085 |

| YR 9 | 690 | 1,220 | 1,090 | 0.216 | 12.940 | 8.023 |

| YR 10 | 110 | 370 | 2,520 | 0.208 | 12.480 | 6.898 |

| YR 11 | 450 | 360 | 2,180 | 0.182 | 10.910 | 6.103 |

| YR 12 | 50 | 140 | 2,820 | 0.166 | 9.980 | 5.349 |

| YR 13 | 390 | 10 | 2,600 | 0.183 | 10.970 | 5.839 |

| YR 14 | 1,710 | — | — | 0.195 | 6.670 | 4.096 |

| Totals: | 18,290 | 10,830 | 11,590 | 0.258 | 210.15 | 130.297 |

The processing method envisioned for the Gibellini Project will be to feed leach material from the mine via loader to a hopper that feeds the crushing plant. The leach material will then be fed to the agglomerator where sulfuric acid, flocculent and water will be added to achieve adequate agglomeration. The agglomerated leach material will be transported to a stacker on the leach pad, which will stack the material to a height of 15 feet. Once the material is stacked, solution will be added to the leach heap at a rate of 0.0025 gallons per minute per square foot. The solution will be collected in a pond and this pregnant leach solution will be sent to the process building for metal recovery where it will go through solvent extraction and stripping processes to produce the vanadium pentoxide.

Vanadium Recoveries and Metallurgical Testing

Approximately 130.3 million pounds of V2O5 is expected to be produced from Gibellini and Louie Hill leaching operations at an average recovery of 62% (oxide: 60%, transition: 70% and reduced: 52%). The heap leaching is performed at ambient temperature and atmospheric pressure without pre-roasting or other beneficiation process. The pregnant leach solution is continuously collected with leach material undergoing, on average, a 150-day heap-leaching cycle. Table 9 below summarizes the projected metallurgical recoveries used in the PEA for the three defined oxidation-type domains.

| Mill Feed Material Type | Direct Leaching Recovery |

| Oxide | 60% |

| Transition | 70% |

| Reduced | 52% |

The direct heap leach vanadium recovery estimates used in the PEA were based on extensive metallurgical testing work performed by SGS Lakefield Research Laboratories, Dawson Minerals Laboratories, and McClelland Laboratories. Samples were selected from a range of depths within the deposit, representative of the various types and styles of mineralization. Samples were obtained to ensure that tests were performed on sufficient sample mass. The end results demonstrated low acid consumption (less than 100 lb acid consumption per ton leached) and high recovery through direct leaching. Notable test results included the following:

Acid Heap Leach Testing of a Gibellini Bulk Sample, McClelland Laboratories, September 4, 2013

A series of trenches were excavated and approximately 18 tons of material were sent to McClelland Laboratories for pilot testing. The material was air dried and stage crushed to 2” where a column sample was cut for 12” columns and then the leach material was crushed to – ½”. A head sample was taken and material for bench marking columns, and a bottle roll test was also taken. The results of the pilot plant testing are shown in Table 10:

| Crush Size 100% Passing | Test Type | Time (Days) | Head Grade %V* |

% Vanadium Recovery |

Acid Consumption lbs/st |

| 50 mm (2”) | Column, open circuit | 123 | 0.299 | 76.6% | 88 |

| 12.5 mm (1/2”) | Column, open circuit | 123 | 0.313 | 80.2% | 72 |

| 12.5 mm (1/2”) | Column, closed circuit | 199 | 0.284 | 68.3% | 84 |

| 12.5 mm (1/2”) | Column, closed circuit | Column, closed circuit | 0.313 | 74.0% | 96 |

| 12.5 mm (1/2”) | Bottle Roll | 4 | 0.286 | 67.1% | 74 |

| 1.7 mm (-10m) | Bottle Roll | 4 | 0.286 | 66.3% | 66 |

| -75µ | Bottle Roll | 4 | 0.279 | 67.6% | 62 |

| -75µ | Bottle Roll | 30 | 0.298 | 74.2% | 54 |

*to convert V to V2O5, multiply V by 1.7852.

Solvent Extraction (SX) Test Work

The design parameters from this test work are:

- SX Extraction pH Range 1.8 to 2.0

- Di-2-Ethyl Hexyl Phosphoric Acid Concentration 0.45 M (~17.3% by weight) Cytec

- 923 Concentration 0.13 M (~5.4% by weight)

- The Organic Diluent is Orform SX-12 (high purity kerosene)

- SO2 addition of 1.0 to 1.5 g/l

- Strip Solution Sulfuric Acid Concentration 225 to 250 g/l SX

- Extraction Efficiency ~97%

- SX Strip Efficiency ~98%

Pilot Scale Solvent Extraction Testing on Vanadium Bearing Solutions from Two Gibellini Project Column Leach Tests, McClelland Laboratories, September 16, 2013

Solvent extraction (“SX”) processing was conducted to recover vanadium from sulfuric acid pregnant leach solution (“PLS”) generated during pilot column testing on bulk leach samples from the Gibellini project. Laboratory scale testing was conducted on select solutions generated during the pilot SX processing, to optimize the SX processing conditions. Additional laboratory scale testing was conducted on the loaded strip solution generated during the pilot SX testing, to evaluate methods for upgrading and purifying it to levels that may be required for sale of a final vanadium bearing product.

The final pregnant strip solution was 6.1% vanadium, 250 g/l sulfuric acid with approximately 2% Fe and Al. The solution was suitable for oxidation using sodium chlorate to convert the V+4 to V+5 which was then precipitated using ammonia to make ammonium metavanadate (“AMV”). To make a vanadium product for the steel industry, this AMV is calcined (ammonia driven off) and heated to above 700°C (the fusion temperature of V2O5). This fused V2O5 would then be cooled on a casting wheel, pulverized and packaged. Additionally, using ion exchange resins in conjunction with solvent extraction, strip solution was produced which met or exceeded specifications of electrolyte for vanadium flow batteries.

In August of 2018, Nevada Vanadium received metallurgical results from its technology partner, NWME from samples collected during a site visit in March of 2018. Tests were performed at it’s laboratory testing facilities located in Xi’an, China. NWME utilized a SX processing method to recover vanadium from sulfuric acid PLS generated by bottle roll and column test acid leaching on Gibellini samples. The solution was reduced and then precipitated using ammonia to make AMV. The AMV was calcined and heated then cooled and pulverized. A vanadium pentoxide with 98.56 % purity content was produced. The assay for this work is shown below:

| V2O5 % | SI % | Fe % | P % | S % | As % | Na2O % | K2O % | Al % | U % |

| 98.56 | 0.0078 | 0.88 | 0.058 | 0.47 | 0.0026 | 0.43 | 0.052 | 0.22 | 0.0001 |

Uranium content is less than 0.0001% which does not affect the marketability of the product.

The PLS was produced with very low deleterious elements which enabled using an efficient SX process. The PLS V2O5 concentration was 1.15 gram per liter and the Pregnant Strip Solution V2O5 concentration was 39.61 grams per liter.

Capital and Operating Costs

The projected capital costs for the Gibellini vanadium project over a 1 ½ year construction period and mine life average operating costs are summarized in Tables 11 and 12 below. The capital cost includes 25% contingency or USD23.4 million.

Capital Costs

| Cost Description | Total (US$000s) |

| Open Pit Mine | |

| Open pit mine development | 1,412 |

| Gibellini incremental WRSF | 212 |

| Mobile equipment | 111 |

| Infrastructure-On Site | |

| Site prep | 2,431 |

| Roads | 1,391 |

| Water supply | 2,007 |

| Sanitary system | 61 |

| Electrical – on site | 2,052 |

| Communications | 165 |

| Contact water ponds | 174 |

| Non-process facilities – buildings | 7,583 |

| Process Facilities | |

| Mill feed handling | 15,380 |

| Heap leach system | 20,037 |

| Process plant | 14,441 |

| Off-Site Infrastructure | |

| Water system | 4,495 |

| Electrical supply system | 3,227 |

| First fills | 860 |

| Subtotal Total Direct Cost | 76,039 |

| Construction indirect costs | 4,254 |

| Sales tax / OH&P | 4,236 |

| EPCM | 8,879 |

| Total Before Contingency | 93,409 |

| Contingency (25%) | 23,352 |

| Total Project Cost | 116,761 |

Operating Costs

| Total Cash Operating Cost | $ per Ton Leached |

$ per lb of V2O5 Produced |

| G&A | 0.99 | 0.31 |

| Mining Cost | 2.72 | 0.85 |

| Total Processing Cost | 11.54 | 3.61 |

| Total | 15.26 | 4.77 |

The cash operating costs in the first half of the project covering years 1-7 is $3.59 per lb of V2O5 produced and for the years 8-14 is $7.12 per lb of V2O5 produced, resulting in the weighted average cash cost of $4.77 per lb of V2O5 produced. The cash operating cost is lower in the first half of the project due to processing higher grade material.

About AMEC

AMEC is a part of Wood Group, a global leader in the delivery of project, engineering and technical services to energy and industrial markets. Wood Group operates in more than 60 countries, employing around 55,000 people, with revenues of over $10 billion. Wood Group provides performance-driven solutions throughout the asset life cycle, from concept to decommissioning across a broad range of industrial markets including upstream, midstream and downstream oil & gas, chemicals, environment and infrastructure, power & process, clean energy, mining, nuclear and general industrial sectors.

Videos

Advise from ELEF Chairman (1min) |

Q&A with ELEF Chairman (3min) |

Nevada Vanadium’s Executive Chairman John Lee, talks about Rare Earth and Vanadium |

Vanadium – Gibellini Skyline Non-YouTube |

Gibellini & Vanadium Introduction 5min Non-YouTube |

Vanadium – Gibellini Heap Leach Animation Non-YouTube |

Vanadium – Gibellini Advancing To Development Non-YouTube |

Vanadium – Gibellini Aerial Looking Eastward Non-YouTube |

Vanadium – Gibellini Aerial Northward Non-YouTube |

Vanadium – Gibellini Aerial Looking North-East Non-YouTube |

Vanadium – Hight Grade Gibellini Alteration Non-YouTube |

Vanadium – Gibellini Trenching Non-YouTube |

Vanadium – Gibellini overlooking Louie Hill Non-YouTube |

Vanadium – Surface Exposure Non-YouTube |

Vanadium – Zoom to Gibellini Non-YouTube |

Maps

Cautionary Note Regarding Forward-Looking Statements

*1. The Qualified Person for the estimate is Mr. E.J.C. Orbock III, RM SME, a Wood employee. The Mineral Resources have an effective date of 29 May, 2018.

2. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3. Mineral Resources are reported at various cut-off grades for oxide, transition, and reduced material.

4. Mineral Resources are reported within a conceptual pit shell that uses the following assumptions: Mineral Resource V2O5 price: $14.64/lb; mining cost: $2.21/ton mined; process cost: $13.62/ton; general and administrative (G&A) cost: $0.99/ton processed; metallurgical recovery assumptions of 60% for oxide material, 70% for transition material and 52% for reduced material; tonnage factors of 16.86 ft3/ton for oxide material, 16.35 ft3/ton for transition material and 14.18 ft3/ton for reduced material; royalty: 2.5% net smelter return (NSR); shipping and conversion costs: $0.37/lb. An overall 40º pit slope angle assumption was used.

5. Rounding as required by reporting guidelines may result in apparent summation differences between tons, grade and contained metal content. Tonnage and grade measurements are in US units. Grades are reported in percentages.

Forward-looking statements on this page relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the PEA representing a viable development option for the project; (ii) construction of a mine at the project and related actions; (iii) estimates of the capital costs of constructing mine facilities and bringing a mine into production, of sustaining capital and the duration of financing payback periods; (iv) the estimated amount of future production, both produced and metal recovered; and (vi) life of mine estimates and estimates of operating costs and total costs, cash flow, net present value and economic returns including internal rate of return estimates from an operating mine constructed at the project. All forward-looking statements are based on Nevada Vanadium’s or its consultants’ current beliefs as well as various assumptions made by them and information currently available to them. The most significant assumptions are set forth above, but generally these assumptions include: (i) the presence of and continuity of vanadium mineralization at the project at estimated grades; (ii) the geotechnical and metallurgical characteristics of rock conforming to sampled results; (iii) infrastructure construction costs and schedule; (iv) the availability of personnel, machinery and equipment at estimated prices and within the estimated delivery times; (v) currency exchange rates; (vi) vanadium sale prices; (vii) appropriate discount rates applied to the cash flows in the economic analysis; (viii) tax rates applicable to the proposed mining operation; (ix) the availability of acceptable financing on reasonable terms; (x) projected recovery rates and use of a process method, that although well-known and proven on other commodity types like copper, has not been previously brought into production for a vanadium project; (xi) reasonable contingency requirements; (xii) success in realizing proposed operations; and (xiii) assumptions that project environmental approval and permitting will be forthcoming from county, state and federal authorities. The economic analysis is partly based on Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA based on these Mineral Resources will be realized. Currently there are no Mineral Reserves on the Gibellini property. Although the Company’s management and its consultants consider these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. Many forward-looking statements are made assuming the correctness of other forward-looking statements, such as statements of net present value and internal rates of return, which are based on most of the other forward-looking statements and assumptions herein. The cost information is also prepared using current values, but the time for incurring the costs will be in the future and it is assumed costs will remain stable over the relevant period.

These factors should be considered carefully, and readers should not place undue reliance on Nevada Vanadium’s or its consultant’s forward-looking statements. Nevada Vanadium or its consultants believe that the expectations reflected in the forward-looking statements contained on this page and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although Nevada Vanadium and its consultants have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Nevada Vanadium or its consultants undertake no obligation to release publicly any future revisions to forward-looking statements to reflect events or circumstances after the date of this news or to reflect the occurrence of unanticipated events, except as expressly required by law.